Trade Resources

The Trade Resources page contains links, documents and other tools for grape growers, wineries, wholesalers and retailers to discover, learn about, obtain tools and connect with various facets of the Colorado wine industry.

Official documents pertaining to the Colorado Wine Industry Development Board reside in a separate section and include CWIDB Meeting Minutes, Fiscal Reports and Budgets, as well as adopted Operating Procedures, policy statements and the establishing legislation.

The Research section contains links to Colorado State’s Western Colorado Research Center–Orchard Mesa, that houses the State Viticulturist and Enologist; Economic Impact Studies, Research Proposals and Reports. There is a document library containing Historical Research Documents, where you can search past research reports and related documents to find information on a specific topic.

And under Educational Resources and Promotional Resources you can find a link to the Western Colorado Community College’s Viticulture & Enology Program, The Colorado Grape Growers Guide, marketing toolkits and more.

FSMA Preventive Controls for Human Food (Wineries)

Board Members

The Colorado Wine Industry Development Board of directors represents the wine industry’s breadth both regionally and through its diversity of business models. The Board is composed of 5 winery, 2 wholesaler, 1 grapegrower, 1 retailer, 1 Colorado Tourism Office ex-officio, 1 Colorado State University ex-officio and 1 public ex-officio representatives.

Establishing statutes

The Colorado Legislature created the Colorado Wine Industry Development Board (CWIDB) as a Type I board under the auspices of the Colorado Department of Agriculture in 1990 under the Colorado Wine Industry Development Act. Colorado Revised Statutes 35-29.5 provides the legislative purpose behind the CWIDB’s creation, it’s purpose, membership, make-up, funding stream and spending mandates.

- Colorado Administrative Organization Act of 1968 §1, defines a Type 1 Board (24-1-105 CRS)

- Colorado Wine Industry Development Act (35-29.5 CRS)

- Legislative Declaration (§101.5)

- Creation and Members (§103)

- Duties and Powers (§104)

- Use of Monies (§105)

- Colorado Wine Industry Development Fee in the Colorado Liquor Code (12-47-503 CRS)

- Colorado Wine Industry Development Fund, revenue sources described in (¶1), sub-paragraphs (b) and (c) CRS)

Click on the Wine Development Act link below for the full text of the statute.

Meeting Agendas

The Colorado Wine Industry Development Board (CWIDB) operates in accordance with the Colorado Open Records Act (CORA) (§§ 24-72-203 and 204, C.R.S.) and the Open Meetings Law (§ 24-6-402 C.R.S.). All meetings are open to the public unless an executive session is announced in advance in accordance with the Open Meetings Law (see above link). Every effort will be made to allow remote attendance to all CWIDB meetings using electronic technology when available.

In general, the CWIDB uses Zoom for remote meeting participation.

To see the agendas for upcoming meetings and to find the Zoom meeting link, please check The Events page for “Wine Industry” events. Each listed CWIDB meeting will contain links to the agenda and the Zoom connection.

Meeting Minutes

Signed minutes from previous meetings of the Colorado Wine Industry Development Board (CWIDB) will be posted on this website once appoved by the board at the following meeting.

Recordings of meetings are also available upon request. Contact Doug Caskey, executive director, 303.869.9177, for more information.

The CWIDB operates in accordance with the Colorado Open Records Act (CORA) (§§ 24-72-203 and 204, C.R.S.) and the Open Meetings Law (§ 24-6-402 C.R.S.). All meetings are open to the public unless an executive session is announced in accordance with the Open Meetings Law (see above link). Every effort will be made to allow remote attendance to all CWIDB meetings using electronic technology when available. In general, the CWIDB uses Zoom to make meetings accessible to board members and the public regardless of where you are. Please check the specific meeting listing for the Zoom meeting link.

Financial documents

CWIDB Financial Documents include the annual production and market-share report for Colorado wine, Colorado Wine Industry Development Fund fiscal reports with revenue and expenditures, as well as the spending budget adopted by the CWIDB for each fiscal year that runs July through June.

CWIDB Documents

This section contains an assortment of documents detailing the operating procedures and other policies adopted by the CWIDB and those from the Colorado Department of Agriculture.

Viticultural Resources

This section contains resources for Colorado grapegrowers.

Retail Liquor Outlets

Restaurants, bars, liquor stores, wine shops and soon to include liquor-licensed drug stores where consumers find Colorado wines. These include the following trade associations:

- Colorado Licensed Beverage Association, representing independent liquor stores

- Colorado Restaurant Association, representing the over 11,000 dining and food service businesses in Colorado

- The Tavern League of Colorado, representing on-premise beverage operators

Cultivar Camp

USDA Specialty Crop Block Grant funded program to provide an educational networking series for the Colorado Wine industry focusing on specific wine grape varieties.

CO Wine Industry Newsletter Articles and Information

The documents and information on this page were originally sent out to the Colorado wine industry in the email newsletters from the Colorado Wine Industry Development Board.

If you would like to be added to the Colorado wine industry emailing list, please contact doug.caskey@state.co.us or 303.869.9177.

FSMA Compliance for Wineries and Vineyards

The Food Safety Modernization Act of 2011 made the most wide-ranging changes to the growing, production and manufacturing of food, which includes beverages such as wine and cider. This section provided resources for both wineries, subject to the Preventive Controls for Human Food rule, and grape-growers, under the Produce Safety Rule.

FSMA Produce Safety Rule for Grape-Growers

Board member resources

Members of the CWIDB can find useful documents here, such as travel expense reimbursement forms, the CDA tax exempt form, and the EFT form required for direct deposit of payments from the state, that must be accompanied by a signed W-9 form.

Business Development Presentations

Business Development Partners

COVID-19 Resources

Responsible Server Training

The CO Wine Industry Development Board offers the TIPS Responsible Server Training in both in-person and live-streamed versions. Please contact Doug Caskey for more information on these trainings, doug.caskey@state.co.us or 303.869.9177.

Phillips-Rhodes Grant

The Colorado Wine Industry Development Board (CWIDB) created an educational grant program available to current members of the Colorado wine industry or to students in Colorado post-secondary programs focusing on viticulture or enology to advance the development of the Colorado Wine and Grape Industry. The CWIDB created this program in memory of two prominent pioneers of the Colorado wine industry, Doug Phillips and Steve Rhodes.

The purpose of the Phillips-Rhodes Memorial Grant is to encourage members of the Colorado wine and grape industries or Colorado college, graduate-level, or post-secondary vocational training students committed to the Colorado wine and grape industries to pursue training, or educational opportunities that will advance the Colorado wine and grape industries. Such opportunities might be in grape-growing, water management, winemaking, marketing, business management, liquor code compliance, safety, or any field closely related to and beneficial for the Colorado wine and grape industries.

For fiscal year 2021, running through June 30, 2021, the program may award up to $6000 for scholarships to pursue post-secondary degrees or professional certificates in viticulture, enology, or subjects closely related and beneficial to the Colorado wine industry, as well as workshops, seminars, or short courses in appropriate topics.

The amount of awards will depend on the number of grants selected for the award cycle based on the review committee’s evaluation process, but will fall between $250 and $3000. The CWIDB reserves the right not to award any money during an award cycle. The Review Committee designated by the CWIDB will make recommendations for awards to the full CWIDB, who will approve the final awards.

The CWIDB does not discriminate on the basis of race, color, nationality, religion, gender, or physical/mental disabilities.

Honoring:

- Doug Phillips, founder of Plum Creek Cellars in 1984, originally in Larkspur. Doug was one of the very early adopters of the Colorado Grown message and recognized the need for quality grape-growing to make quality wine. So he moved his operation to the Grand Valley and planted many grapes along G Road, on East Orchard Mesa as well as in the West Elks. He was instrumental in writing and passing the Colorado Wine Industry Development Act in 1990 and served as the Wine Board’s first chair until 1998. And he was the visionary behind the Colorado Mountain Winefest.

- Steve Rhodes, an accomplished cellist, spent his formative early adult years in a California wine cellar. He returned to Colorado to take over the family’s farm and planted grapes on the slopes of the West Elks AVA between Hotchkiss and Paonia. Winemaking for Steve was as much about magic and passion as it was about science, but “he always had some mighty fine wine.” He spread the bounty of Colorado wine to restaurants in Aspen and liquor stores along the Front Range one case at a time, and over time he created a very loyal and extremely enthusiastic following for S. Rhodes Vineyards.

The families and estates of Doug Phillips and Steve Rhodes are not involved in and derive no fiscal benefit in any way from this grant program. It is intended solely to memorialize the contributions both people made to growing and improving the Colorado wine industry and to honor their memories.

Soil Health

Soil health resources

Water Conservation

2023 CWIDB Meeting Minutes

CSU Extension Videos and Resources

Links to videos and content created by CSU Extension Viticulture Specialist, Charlotte Oliver, PhD.

Click here to visit viticulture.colostate.edu, the Colorado Grape Growers page.

Oral History of the Colorado Wine Industry

These recorded interviews and documents recall the early days of the Colorado wine industry as told by some of the pioneering winemakers, grape growers, and supporters.

Colorado Liquor Enforcement Divisions

The mission of the Liquor Enforcement Division is to gain and monitor compliance with Colorado liquor and tobacco laws and regulations through education, outreach, licensing, inspections and enforcement activities in conjunction and cooperation with local and state enforcement officials, local licensing authorities, the industry, advocacy and community groups and the general public.

Historical resources

Access documents about the history of the Colorado wine industry here.

Business development

Resources to assist in developing, growing, and running your business.

Government links

Link to various wine-related government websites here.

Presentations

Access videos and presentations here.

Promotional Resources

This page houses information pertaining to Colorado Wine promotional materials, and is intended to give Colorado wineries and retailers easy access to all the tools needed to use materials that will help them grow their businesses.

CO Wine Board

The Colorado Wine Industry Development Board is a semi-independent state board in the Colorado Department of Agriculture created for the purpose of encouraging and promoting agricultural and enological research and experimentation to develop maximum yields and quality from Colorado lands suitable to the production of grapes for commercial wine production, to promote the marketing of wines and wine grapes produced in Colorado, to promote the responsible consumption of all wines, to promote the integration of the Colorado wine industry as a component of the state’s tourism program, and to serve as a resource for the entire wine industry of Colorado.

Promotional materials

The Colorado Wine Board has compiled a range of useful resources and documents to assist you in promoting the wine industry. If you don’t find what you are looking for here, please contact us for assistance.

Research

Access items like Annual Reports, Economic Impact Studies, and more. These resources provide an in-depth look at the research activities designed to advance your business.

Colorado Wine Industry Development Board

The Colorado Wine Industry Development Board is a semi-independent state board in the Colorado Department of Agriculture created for the purpose of encouraging and promoting agricultural and enological research and experimentation to develop maximum yields and quality from Colorado lands suitable to the production of grapes for commercial wine production, to promote the marketing of wines and wine grapes produced in Colorado, to promote the responsible consumption of all wines, to promote the integration of the Colorado wine industry as a component of the state’s tourism program, and to serve as a resource for the entire wine industry of Colorado.

Colorado Cider Guild

The Colorado Cider Guild is an organization for commercial producers of hard cider and perry in Colorado. Its mission is to educate consumers and buyers of craft cider and perry; promote the sale of Colorado made cider and the cultivation of apples for cider production; represent Colorado cider makers with legislative, regulatory, retail and distributional issues in the state.

Brewers Guild

The Colorado Brewers Guild (CBG) is a non-profit trade association who promotes and protects the Colorado craft brewing industry. With the majority of the 300 licensed Colorado breweries as members, CBG provides information for Colorado beer lovers, and promotes Colorado craft breweries by advocating for Colorado craft beer with policymakers.

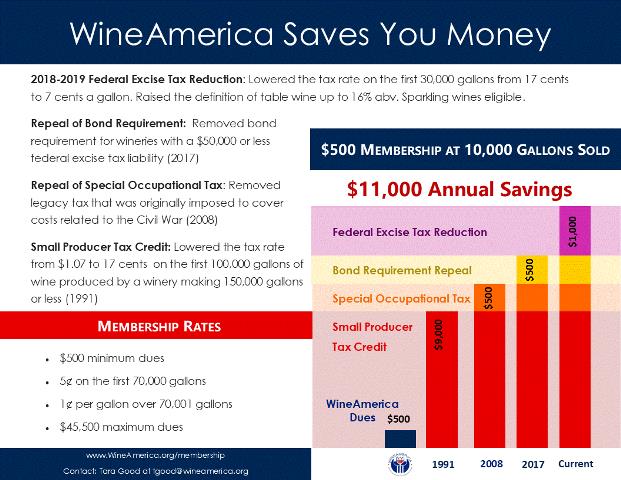

WineAmerica

The national association of American wineries

With more than 600 members, WineAmerica serves the interests of wineries in all 50 states by leveraging its formidable grassroots lobbying strength to benefit the entire industry. Besides offering policy guidance and government affairs advocacy for the national wine industry, WineAmerica also provides member discounts for UPS shipping, TiPS responsible server training, ShipCompliant direct-to-consumer compliance services, and some of the best labeling and COLA advice available anywhere.

Additionally, WineAmerica’s advocacy activities on the federal level have saved small wineries lots of money over the years when they have successfully lobbied for reduced excise taxes and more. These cost savings more than make up for the membership fees.

CAVE

Colorado Association for Viticulture & Enology

Colorado wine industry’s private trade association and the producer of The Colorado Mountain Winefest the third Saturday of every September in Grand Junction and Palisade, Colorado.

Pest Mitigation and Invasive Species

Educational Resources

This section is filled with information for winery owners, wine grape growers, winemakers, tasting room staff and others related to the Colorado wine industry.

2014 CWIDB Meeting Minutes

Colorado Wine Board (CWIDB)

Access Meeting Agendas, Meeting Minutes and Financial Reports related to the Colorado Wine Industry Development Board.

Training material

We have number of resources about the Colorado wine industry to support members of the wine trade in your role as buyers, sellers, promoters and educators.

2022 CWIDB Meeting Minutes

2015 CWIDB Meeting Minutes

Economic and market studies

Access Consumer Surveys, Economic Impact Studies, and the annual production and market share report for the Colorado Wine Industry.

Wine Industry Impact

Access documents related to the impact of the Colorado Wine Industry.

Annual Quarterly and Progress Reports

Access Annual and Quarterly Reports related to the Western Colorado Research Center.

Viticultural & Enology research

New! Colorado Grape Growers’ Website

viticulture.colostate.edu

Access Colorado State University Viticultural and Enology Research Page by clicking above.

Annual Research Reports are below.

Western Colorado Community College

WESTERN COLORADO COMMUNITY COLLEGE

2016 CWIDB Meeting Minutes

Viticulture Resources and Information

View documents from 2014 and before pertaining to viticultural practices and information.

Colorado State University

Dr. Charlotte Oliver is the new Extension Viticulture Specialist. 970-241-3346 or cloliver@rams.colostate.edu.

Visit viticulture.colostate.edu for CSU Extension announcements and resources.

CSU Western Colorado Research Center

Colorado State University’s Viticulture and Enology Programs as well as the regional Extension offices are housed at:

Western Colorado Research Center – Orchard Mesa

3168 B 1/2 Road, Grand Junction, CO 81503

Dr. Horst Caspari, State Viticulturist, 970.434.3264 (x204), horst.caspari@colostate.edu

Click here to go to CSU Viticulture Research page.

Dr. Stephen Menke, State Enologist, retired, Stephen.Menke@colostate.edu

Annual Reports from the CSU Viticulture and Enology Research are shown below.

Technical Reports

View technical reports to the Colorado wine industry from CSU’s Western Colorado Research Center at Orchard Mesa and other sources.

2017 CWIDB Meeting Minutes

Historical Research

A compilation of historical research documents prior to 2014. Use the search feature to find specific topics. Use the “Sort by” pull-down menu to view by date of the document or by title.

Research Reports

View reports of viticultural research performed at CSU’s Western Colorado Research Center at Orchard Mesa.

2018 CWIDB Meeting Minutes

Project Proposals

Read the project proposals submitted to the CWIDB.

2019 CWIDB Meeting Minutes

Partner Organizations

The Colorado Wine industry relies heavily on the support, the resources and cooperation from these partner organizations. We are grateful to them.

2020 CWIDB Meeting Minutes

2021 CWIDB Meeting Minutes

Media and Miscellaneous

This section contains publications from the early 1990s Colorado wine industry as well as an assortment of student theses and reports.

Click here to view all 2024 Legislative/Business Development Meeting Agendas. Navigate to different months using the ‘Outline’ on the left …

2024 Legislative/Business Development Meeting Agendas

Click here to view all 2024 Legislative/Business Development Meeting Agendas. Navigate to different months using the ‘Outline’ on the left side.

Click here to view all 2023 Legislative/Business Development Meeting Agendas. Navigate to different months using the ‘Outline’ on the left …

2023 Legislative/Business Development Meeting Agendas

Click here to view all 2023 Legislative/Business Development Meeting Agendas. Navigate to different months using the ‘Outline’ on the left side.

Click here to view all 2024 Marketing Meeting Agendas. Navigate to different months using the ‘Outline’ on the left side. …

2024 Marketing Meeting Agendas

Click here to view all 2024 Marketing Meeting Agendas. Navigate to different months using the ‘Outline’ on the left side.

Click here to view all 2023 Marketing Meeting Agendas. Navigate to different months using the ‘Outline’ on the left side. …

2023 Marketing Meeting Agendas

Click here to view all 2023 Marketing Meeting Agendas. Navigate to different months using the ‘Outline’ on the left side.

Click here to view all 2024 Research and Quality Meeting Agendas. Navigate to different months using the ‘Outline’ on the …

2024 Research and Quality Meeting Agendas

Click here to view all 2024 Research and Quality Meeting Agendas. Navigate to different months using the ‘Outline’ on the left side.

Click here to view 2023 Research and Quality Meeting Agendas. Navigate to different months using the ‘Outline’ on the left …

2023 Research and Quality Meeting Agendas

Click here to view 2023 Research and Quality Meeting Agendas. Navigate to different months using the ‘Outline’ on the left side.

To see the agendas for upcoming meetings and to find the Zoom meeting link, please check The Events page for …

CWIDB Meeting Agendas

To see the agendas for upcoming meetings and to find the Zoom meeting link, please check The Events page for “Wine Industry” events. Each listed CWIDB meeting will contain links to the agenda and the Zoom connection.